Read what Daniel Appleton, one of Insight’s directors and financial adviser, says about the current market conditions.

26th March 2020

During the last 4 weeks and in particular the last 2 weeks, markets have seen unprecedented levels of volatility, with every asset class coming under pressure. Equities have of course seen the greatest level of volatility both on the down and upside. This is shown within the US markets, during the week commencing the 9th of March where there were days of heavy falls and then on the final day of the week, Friday 13th March there was approximately a 10% rally. This rise was then followed on the next trading day Monday 16th March with the worst ever one day fall, in the region of 12%.

We have also seen other assets such as bonds and gold, (the so-called safer havens) experience both rises and falls, as markets try to understand and make sense of what is happening. Added to this we have seen the inevitable gating of Property funds, with fund managers taking this action before any of their usual trigger points have even been reached.

Gating essentially means the funds have been closed to money going in or coming out for a period of time, in order to protect the fund and its investors. Property funds will hold actual bricks and mortar, and this typically comprises of around 85% of the fund, with the other 15% in cash based assets. It becomes much harder for funds to value their properties in times like these and further still should too many investors wish to withdraw at the same time, the cash position could run too low, forcing the fund to have to sell properties in a period that may not provide them with the best price.

Unlike other market corrections that would have been caused by some kind of financial or economic factor, this one has been triggered by an exogenous factor that has created significant uncertainty. This factor has in turn caused major disruption to the world economy and essentially caused many businesses to temporarily close their doors.

Uncertainty is the one thing that markets do not like and they have been navigating somewhat blind over the last couple of weeks now. However, as countries begin to find their way through Covid 19, so will markets.

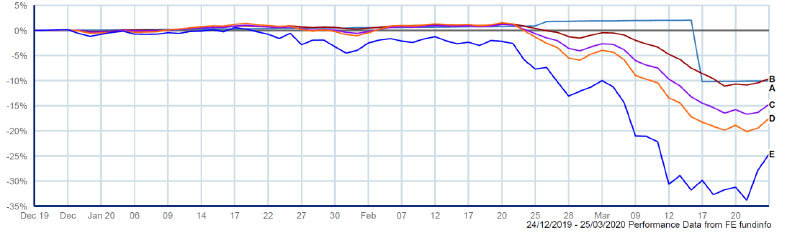

No investment fund has escaped the current volatility even the most defensive or those with a smoothing process, such as the widely used Prudential Prufund investment range. You will see from the chart below, for the 3 month period up to 25/03/2020 the movements that have been experienced in the different risk categories.

A) The smoothed Prudential Prufund Growth Fund.

B) The average return for the mixed investment 0 -35% share sector (Defensive managed Funds).

C) The average return for the mixed investment 20 -60% share sector (Cautious managed Funds).

D) The average return for the mixed investment 40 -85% share sector (Balanced managed Funds).

E) The FTSE 100 (top 100 UK companies)

First, it’s important to remember why you are investing. Investing should be about helping you achieve what you want in life, be it a comfortable retirement or another more tangible goal over the long term. Investing in shares can help with that. The equity market in the United Kingdom has averaged a return of 5% after inflation since 1900, but it is never a smooth run. Returns come in fits and starts. That’s what investing is about – accepting the short-term risk for the potential of longer-term benefit.

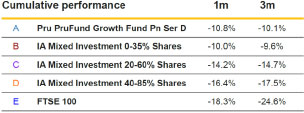

If you look at the data more closely, it’s surprising how quickly stock market returns can be generated. In the graph below, the blue line shows the return of the FTSE All-Share Index since January 1986. The grey line shows how this return would be eroded if you missed the ten best days over that period. Trying to time the market could cost you half your return. This is why it’s often said that time in the market is more important than timing the market.

What can you do to help your investments – If you take a regular income or regular withdrawals you may wish to reduce these or even stop them for a short period of time if you are in a position to do so and utilise any cash. This can help a portfolio to maintain as many units as possible, which of course can be beneficial for future recovery. This is something that you should discuss with your adviser before making any decisions.

If you have any planned capital expenses that would involve drawing down from a pension or investment portfolio, you may wish to consider deferring this for a short period also. This will enable the holdings to benefit from future recovery and negate the impact of having to sell more units to meet a withdrawal in the present climate.

What are the positives – The world is looking to China and South Korea who appear to be making positives steps, with businesses reopened and travel restrictions lifted and we all hope that the flattening curve with regards to the reducing number of cases continues and remains under control.

Governments and central banks have stepped in very quickly with unprecedented levels of support for the economy, businesses and individuals. They also continue to add to this, as has been seen here in the UK, with support coming for the self-employed also.

The world and nations have come together and here in UK we have shown that we are at our best in times of trouble. This can be seen by the vast number of retired medical professionals that have come back to support our fantastic NHS! The government has called for 250,000 volunteers and in just 48 hours more than double this number have already answered the call.

Opportunities – with any market correction also comes opportunity and as a business we are continually exploring these with our business partners. Of course, the opportunity to invest in a lower market is a clear one, however there are many other investment opportunities that will become available.

If you require any advice on your existing portfolios or wish to discuss any potential opportunities, please do not hesitate to contact your adviser.

Above all else please Stay Safe!

Daniel Appleton Dip PFS

Director

Independent Financial Adviser

Insight Financial Associates